- Home

- 5

- About Us

- 5

- Support Us

- 5

- Planned Giving

Gifts of Life Insurance

Make a significant gift to McLean even without a large estate. Here's how you can leverage your dollars for a larger gift.

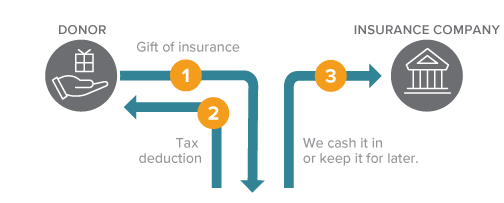

How It Works

- You transfer ownership of a paid-up life insurance policy to McLean.

- McLean elects to cash in the policy now or hold it.

- Consider naming McLean in your long-term plans. It's simple.

Benefits

- Make a gift using an asset that you and your family no longer need.

- Receive an income tax deduction equal to the cash surrender value of the policy.

Next

- Frequently asked questions on gifts of life insurance.

- Contact us so we can assist you through every step.

The gift planning information presented on this site is intended as general. It is not to be considered tax, legal, or financial advice. Please consult your own personal advisors prior to any decision.

Read full disclaimer|Site Map|Planned Giving Marketing Content © 2024 by MajorGifts.com.